Data Sources and Integration

We are integrating major global data sources to provide comprehensive market data

for your

quantitative strategies

Real-time Market Data

Historical Data Backtesting

Third-party Data Providers

Social Media Data

News Event Data

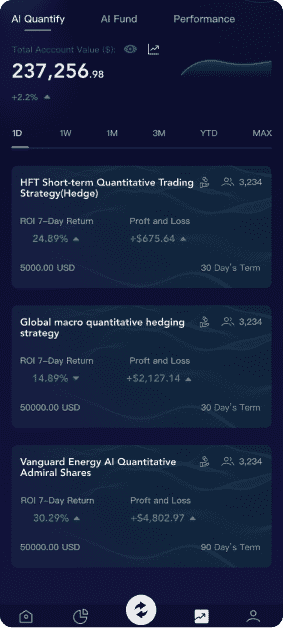

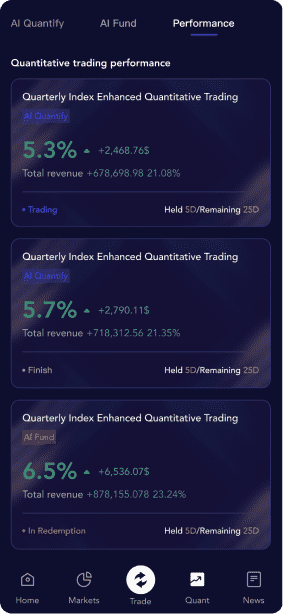

Quantitative trading performance

The Quarterly Index Enhanced Quantitative Trading strategy combines multiple

advantages,

including high returns, short-term gains, data-driven decision-making, transparency,

professional

management, and diversification benefits. These advantages make it a compelling investment

choice for

investors, allowing it to stand out in the modern investment landscape as an ideal option

for those

seeking

stable and efficient returns.

Impressive Return Rate

High Total Revenue

Third-party Data Providers

Disciplined Investment Approach

Transparency and Monitoring

Advantages of Quantitative Strategies

Quantitative strategies are increasingly favored by investors in modern financial

markets. By

utilizing mathematical models and

statistical methods, quantitative strategies can systematically analyze market data and make investment decisions. Here are some key

advantages of quantitative strategies:

statistical methods, quantitative strategies can systematically analyze market data and make investment decisions. Here are some key

advantages of quantitative strategies:

Data-Driven Decision Making

Quantitative strategies rely on extensive historical data and real-time

market

information to make decisions. This approach can reduce the influence of emotions

and intuition on

investment decisions, thereby enhancing objectivity and reliability.

Efficient Execution

Quantitative strategies can leverage high-frequency trading technology to

execute trades

at extremely high speeds. This efficient execution can capture fleeting market

opportunities, thereby

increasing investment returns.

Risk Management

Through quantitative models, investors can measure and manage risks more

precisely. These

models can monitor market risk factors in real-time, provide risk warnings, and help

investors adjust

their portfolios in a timely manner to avoid potential losses.

Diversification

Quantitative strategies can simultaneously monitor and trade multiple

asset classes and

markets, achieving high portfolio diversification. This diversification can

effectively reduce the

impact of fluctuations in a single asset or market on the overall portfolio.

Backtesting and Optimization

Quantitative strategies can undergo historical backtesting before

implementation to

evaluate their performance under different market conditions. Through backtesting,

investors can

optimize strategy parameters, enhancing the strategy's effectiveness and

adaptability.

Quantitative strategies combine advanced

mathematical and

statistical methods to

significantly

enhance the scientific and predictable nature of investments through data-driven decisions,

precise risk

management, efficient execution, diversified portfolios, consistent strategy execution,

historical

backtesting and optimization, and high automation. In the highly competitive financial markets,

quantitative

strategies provide investors with powerful tools to achieve higher investment returns and more

stable

performance.